Gold Price Today

As of October 10, 2023, the price of Gold

| Country | Weightage | Currency | Today | Changes | Trend |

|---|---|---|---|---|---|

| USA | Ounce | Doller | 1,858.76 | -3.81 -0.20% | ▼ |

| India | Gram | Rupees | 4,972.52 | +10.95 +0.22% | ▲ |

| UAE | Ounce | AED | 6,827.27 | +26.33 +0.39% | ▲ |

| Europe | Ounce | Euro | 1,760.45 | +3.75 +0.21% | ▲ |

| Russia | Ounce | Ruble | 185,793.25 | +1094.24 +0.59% | ▲ |

| China | Ounce | Yen | 13,319.18 | -183.21 -1.36% | ▼ |

| Brazil | Ounce | Brazilian Real | 9,544.29 | -26.60 -0.28% | ▼ |

| South Africa | Ounce | South African Rand | 35,922.42 | -40.70 -0.11% | ▼ |

Market Trends:

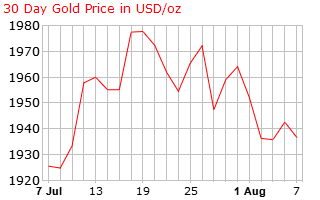

Gold prices keep clinging to support around $1,950 per ounce as it battles to garner optimistic investor attention; nevertheless, one market expert believes the precious metal is well positioned to benefit from the US dollar’s diminishing reserve currency status.

Fitch Ratings’ downgrade of US debt last week might be the spark that sparks a larger fire in global financial markets.

The current bond market volatility, with 10-year note rates hovering around 4%, is a strong indication that investors are losing trust in the US currency.

“The bond market always gets it right. It’s relaying the tale of how the system is failing. The United States has an issue that they will never solve. A rising number of countries are abandoning the dollar system, making it harder for the government to find buyers for US treasures. The Fed might intervene shortly, which will be intriguing for gold.”

Investors are seeing indicators that the global bond market is collapsing under the weight of increasing deficits. The bond market in the United Kingdom had a crisis of confidence in October, following the publishing of a mini-budget by newly appointed Prime Minister Liz Truss that offered the nation’s largest tax cuts in 50 years.

A fresh fissure appeared two weeks ago, when Japan’s 10-year bond yield reached a nine-year high.

“We are witnessing a bond market breakdown.” “Something isn’t right.” “Gold may not react immediately to these warning signs, but it will react eventually.”

As the de-dollarization movement gains traction, gold’s significance as a monetary metal is only beginning to emerge. In the foreseeable future, central bank gold demand will continue to dominate the market.

Factors Influencing Gold Prices:

Value of the U.S. Dollar

The price of gold is generally inversely related to the value of the U.S. dollar because the metal is dollar-denominated. All else being equal, a stronger U.S. dollar tends to keep the price of gold lower and more controlled, while a weaker U.S. dollar is likely to drive the price of gold higher through increasing demand (because more gold can be purchased when the dollar is weaker).

As a result, gold is often seen as a hedge against inflation. Inflation is when prices rise, and by the same token, prices rise as the value of the dollar falls. As inflation ratchets up, so does the price of gold.

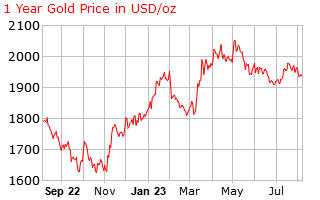

The impact of inflation and the value of the dollar can be seen in the recent price action of gold. As inflation soared in 2022, the price of gold actually declined throughout much of the year, partly owing to the strength of the dollar against other world currencies. However, after hitting a low of less than $1,630 per ounce in September and October 2022, the price of gold began to recover, with the persistence of inflation and concerns about a recession bolstering prices throughout the fourth quarter and into 2023.

Worldwide Jewelry and Industrial Demand

Jewelry accounted for approximately 44% of gold demand in the first half of 2022, according to the World Gold Council. India, China, and the United States are large consumers of gold for jewelry in terms of volume. Another 7.5% of demand is attributed to technology and industrial uses for gold, where the metal is used in the manufacturing of medical devices like stents and precision electronics like GPS units.

As such, gold prices can be affected by the basic theory of supply and demand. This means that as demand for consumer goods (like jewelry and electronics increases), the cost of gold can rise.

Wealth Protection

During times of economic uncertainty, as seen during times of economic recession, more people begin investing in gold because of its enduring value. Gold is often considered a safe haven for investors during turbulent times.

When expected or actual returns on bonds, equities, and real estate fall, the interest in gold investing can increase, driving up its price. Gold can be used as a hedge to protect against economic events like currency devaluation or inflation. In addition, gold is viewed as providing protection during periods of political instability.

Investment Demand

Gold also sees demand from exchange-traded funds (ETFs). These are securities that hold the metal and issue shares that investors can buy and sell just like stocks. The SPDR Gold Trust (GLD) is the largest and held more than 915 tons of gold in January 2023.

While some ETFs represent ownership in the actual metal, others hold shares of mining companies rather than actual gold.

Gold Production

Major players in worldwide gold mining include China, South Africa, the United States, Australia, Russia, and Peru. The world’s gold production affects the price of gold, another example of supply meeting demand. Gold mine production was roughly 3,000 metric tons per year in 2020 and 2021, down from a peak of around 3,300 metric tons per year in 2018 and 2019.

Despite increases starting around 2010, gold mining production has not changed significantly since 2016.

One reason is that the easy gold has already been mined. Miners now have to dig deeper to access quality gold reserves. The fact that gold is more challenging to access raises additional problems: Miners are exposed to additional hazards, and the environmental impact is heightened. In short, it costs more to get less gold. These add to the costs of gold mine production, sometimes resulting in higher gold prices.

Disclaimer:

The information provided in this article is for informational purposes only and should not be considered financial advice. Investors are advised to conduct their own research or consult with a financial advisor before making any investment decisions.

Gold Price Today | Tuesday, 10/10/23 | Gold Price in US, India, UAE, Europe, Russia, China, Brazil, South Africa – HD News Live https://t.co/CweOfniTad

— HDNewslive (@HDNewslive) October 10, 2023

FAQ

Which Country has highest Gold Reserves?

United States of America

Which country has cheapest gold?

The cheapest country to buy gold in is Hong Kong. The price of gold in Hong Kong is typically lower than the global average. This is because there is a large amount of gold trading activity in Hong Kong.

What is gold price today?

What is gold rate today?

Gold Price Today

Gold Price Today

Gold Price Today

Gold Price Today. Gold Price Today Gold Price Today Gold Price Today Gold Price Today Gold Price Today Gold Price Today Gold Price Today Gold Price Today. Gold Price Today